⏱ Back in time: Silicon Valley, startups, and what we can learn from them!

The kings of shaving & the Bitcoin millionaires locked out of their fortunes

Inside Revolut’s bid to become a bank

Mind-blowing Expert Forecasts of Bitcoin Trends in 2021

The Unauthorized Story of Andreessen Horowitz

Key players: LivePerson, Amazon Lex, Apple, IBM Watson, Google, PayPal, LiveChat, Kasisto others.

https://twitter.com/austin_rief/status/1345894777510907904

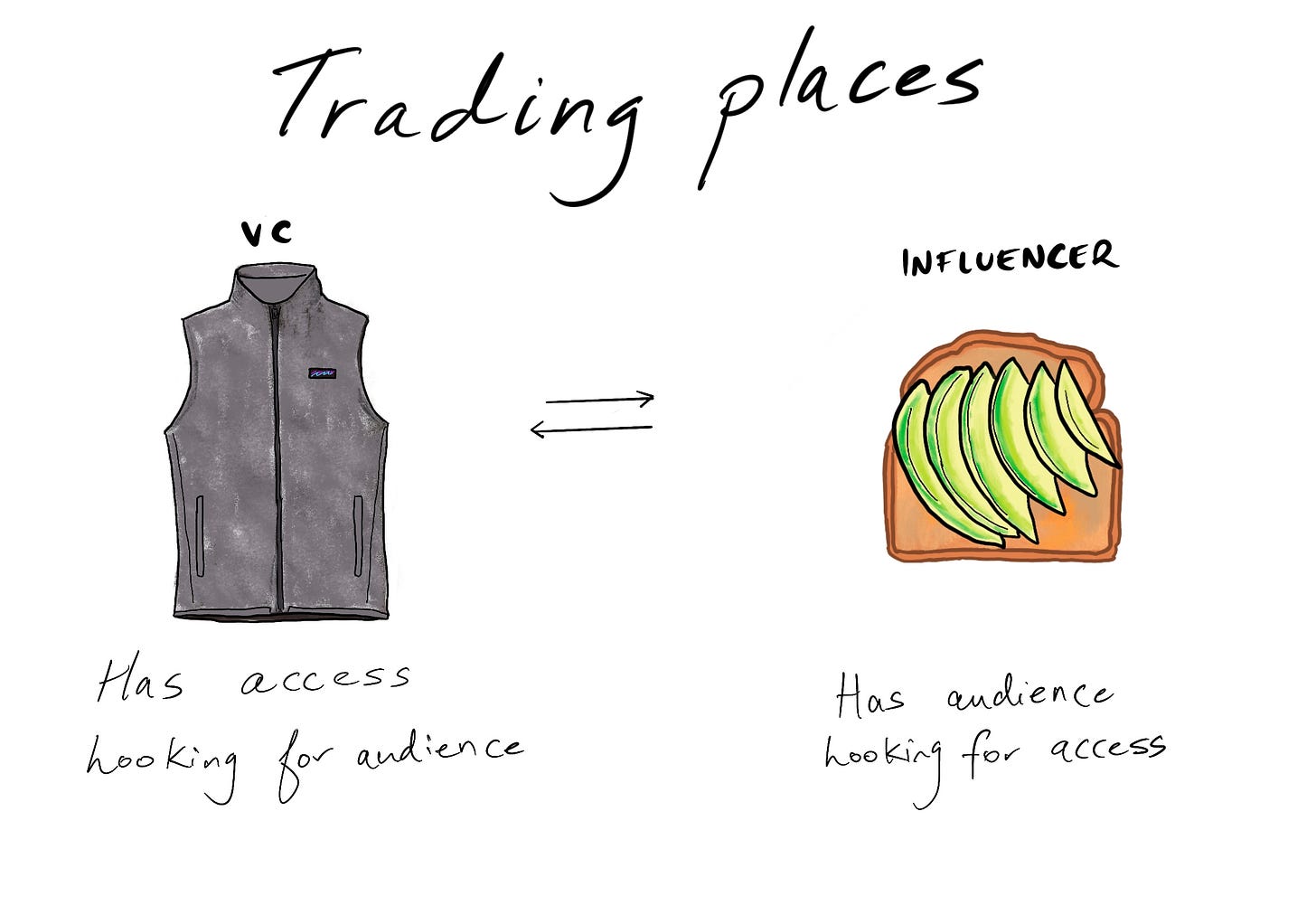

In Power in the Valley, I described how the expansion of the venture asset class (aided by a zero-interest environment) and the mainstreaming of tech culture had resulted in an abundance of undifferentiated private market capital allocators. In a bid to keep up with the competition, venture firms have adopted increasingly similar portfolio services, commoditizing themselves in the process. The only real differentiating features, I argued, were personal ones: the best-performing VCs of the 2020s would-be titans of EQ, winning deals through the power of their personality.

This wasn't just because founders prefer to work with these people, but because these investors bring a tangible, differentiated benefit to the table: distribution. The VC with a million Twitter followers or a beloved podcast offers not just money or advice, but an audience. By working with personalities, founders effectively (and perhaps permanently) lower their blended cost of acquisition. Every time someone like Alexis Ohanian tweets about a portfolio company, he generates traffic for the business.

As distribution becomes the primary mode for capital allocators to differentiate themselves, VCs will increasingly optimize themselves to acquire "customers," effectively subsidizing future portfolio companies' CAC. In doing so, they'll look and act increasingly like influencers, expanding their presence on TikTok, YouTube, Twitch, and elsewhere.

As investors scale their personalities, personalities will look to scale their investing. Individuals like Ninja, MrBeast, Addison Rae, Loren Gray, and others have already done the hard part: amassing a loyal following. But building enduring wealth may require thinking beyond advertisements and endorsements.

In December, Charli D'Amelio announced her first venture investment into teen banking startup, Step. I expect many to follow her over the next twelve months. With social and real capital to be made in the private markets, expect more YouTubers, podcasters, streamers, and writers to show up on cap-tables, taking share from the capitalists seeking to emulate them.

The boom in banking infrastructure means that today, ‘everyone can be a fintech.’

Users can now spend with Apple or Google, Uber operates mobile wallets for its drivers, and Facebook is helping build a cryptocurrency.

So it’s only a matter of time before TikTok — the most downloaded app of 2020 — follows suit.

TikTok allows millions of users worldwide to curate short-form videos. and is particularly popular among teenagers (Gen Z).

No surprise then that Chinese-based TikTok is already reportedly looking at securing a banking license, according to the Financial Times.

This is consistent with reports by the Wall Street Journal that TikTok’s parent company, ByteDance, wants to build out a franchise far beyond video-streaming.

TikTok’s financial play might take the form of peer-to-peer payments or even mobile wallets to allow users to buy products advertised immediately in the app curators.

Mobile wallets could also be utilised by influencers who partner with large brands on the app.

Gen Z has over $143 billion in spending power, making them a lucrative audience to onboard for financial services.

A small handful of fintechs have also reached this billion-dollar milestone in record time.

This is partly dependent on external factors, like funding circumstances at the time of a capital raise. Nonetheless, comparing valuation timelines helps differentiate the herd of unicorns, and showcases where the “hype” has been most intense.

eg. Revolut, Brex, Figure, Symphony

SPACs raised about $64 billion across 200 listings in 2020, remarkable given that traditional IPOs brought in a reported $67 billion. This might be the year we see the new swap places with the old, as SPACs bring in even more money than traditional listings.

With $2.8 trillion worth of dry powder in the private markets (including $1 trillion devoted to buyouts), there remains plenty of money on the sidelines looking for suitable targets. The outperformance of 2020's venture-backed IPO class may encourage founders and investors to pull forward trading in the public market while the going is good, resulting in smaller businesses reaching retail investors.

As part of an emerging trend, expect an increasing number of venture firms to offer SPAC services to portfolio companies in a bid to accelerate the path to liquidity and grow their holdings. To date, Lux Capital, Firstmark, Tusk Ventures, and Ribbit Capital have all created SPACs — 2021 will see a further dozen or more join the ranks. The ideal targets for venture SPACs are portfolio companies that have been on the books for the better part of a decade and have yet to reach an exit. In this respect, investors in venture SPACs may have to grapple with some degree of adverse selection, as the most commercial companies eschew the assistance.

Three SPACs, I'd like to see happen:

The last global financial crash was not an easy time for southern European nations. Unemployment skyrocketed as fragile economies buckled, and many in the region fear we could be in for more of the same this time around.

Signs of a widening gap between northern and southern European startups are already showing. While Europe as a whole looks set this year to exceed funding levels compared to 2019, investment in Spanish startups has fallen by more than half.

Government support programmes for the tech sector also paint a worrying picture for the south. As countries like Germany and France rolled out €2bn and €4bn support schemes respectively, the tech sector in Portugal was treated to €25m in aid measures.

There is hope that the European Recovery Fund will go some way to prevent the gap widening further. Back in August, the EU agreed to a €750bn relief package that will disproportionately benefit smaller European economies, but veterans of the last financial crash believe it will be inadequate to create a truly integrated Europe.

The gathering storm of recession and unemployment will hit Europe hard when furlough schemes come to an end. When it does, the continent’s smaller economies will be far less equipped to weather it.

Trends #0050 - Non-Fungible Tokens (NFTs)

Decentralized exchanges are overtaking centralized incumbents

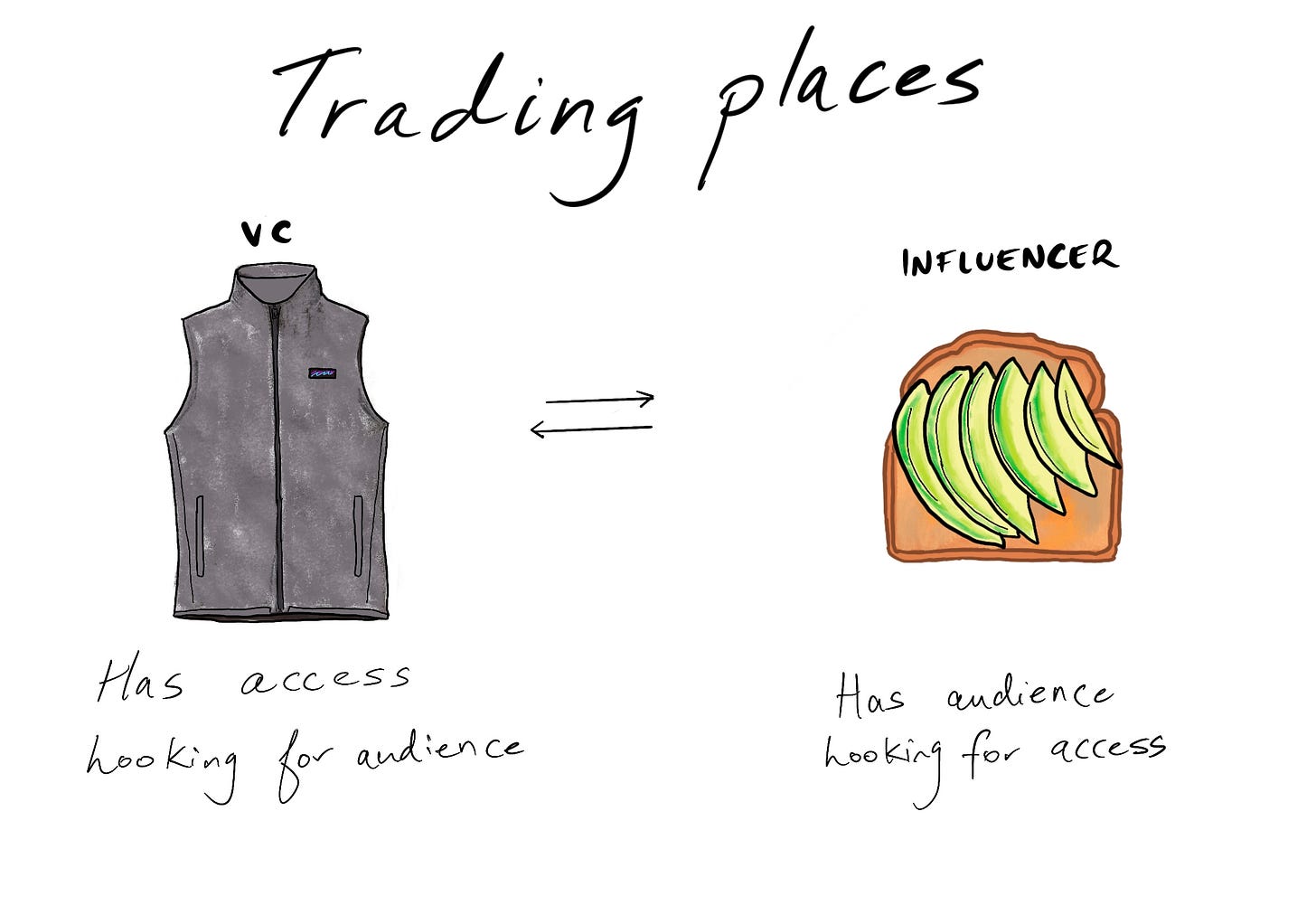

The total value of all cryptocurrencies passed $1 trillion Wednesday for the first time ever, per CoinGecko‘s index of 6,124 assets. At its prior peak in late 2017, the market’s total capitalization was just above $760 billion, according to TradingView.

Bitcoin represents roughly 69% of the market’s value, according to Messari.

This is the point at which I must say: this is not investment advice. Anyone that's observed bitcoin over the past few years will know that even cryptocurrencies occasionally obey the laws of gravity. Startling tumbles often follow head-swimming run-ups. In late 2017, bitcoin's price neared $20K; a year later, it stood at less than $3.5K.

But there's reason to heed that dangerous phrase: this time is different. For one thing, the line of argumentation has changed. During the last bull-run, skeptics dismissed bitcoin's very viability, considering it unnecessary, overpriced, likely to fade into obscurity. This time around, the conversation is very different, with an increasing proportion of money managers and economists accepting the asset is here to stay, in some capacity.

That change in mood has manifested with early signs of corporate adoption. MicroStrategy, a business intelligence platform that trades on the Nasdaq, made waves when it invested $425 million of its balance sheet in bitcoin, with CEO Michael Saylor explaining, "I want something that I could put $425 million into for 100 years." The company has doubled-down since then, investing a cumulative $1.125 billion as of December.

Given their profiles, Square and MassMutual getting in on the action may be more significant. The payment processor invested $50 million in October, while the 169-year old insurer purchased $100 million in December. That represented 0.04% of the latter’s general investment account.

The case for bitcoin at $100K is simple: get more companies to invest 0.04% (or more) into the asset. Some expect considerable movement on this front over the next twelve months, with investor Bill Miller foreshadowing a "torrent" of corporate investment into the asset. Pierre Rochard, a "bitcoin strategist" at crypto exchange Kraken, expects 50% of the S&P 500 to hold BTC on their balance sheet by year-end.

While Rochard's claims seem overly optimistic, we should expect other major corporations to jump aboard the bitcoin bus. A few projected early adopters:

Cash App is a mobile app created by Square that includes features for peer-to-peer payments and investing.

Cash App was responsible for approximately half of Square’s Q3 profits. And the app’s net income is growing at 212% (compared to 59% annual growth for Square as a whole).

It looks like the app has more room for growth: Cash App currently has 30 million monthly active users. This number is forecasted to rise to 66 million by 2023.

What’s next: Cash App is part of the fast-growing P2P payment app industry. 30.6% of Americans have made a P2P payment over the last year. And it’s estimated that the P2P market will grow from $1.85B today to $4.49B by 2027. Other players in the P2P space include Chime Bank, Venmo, Zelle and Transferwise.

Basic income and cryptocurrencies

eg. Circles is a basic income made to promote local economy within your community.

People are really exchanging things or services for this currency.

Though the IPO market was red-hot, M&A activity declined in 2020, with the US down 29%. Expect a reversal of that trend in 2021, with last year's big winners using their new bulk to expand their fiefdoms.

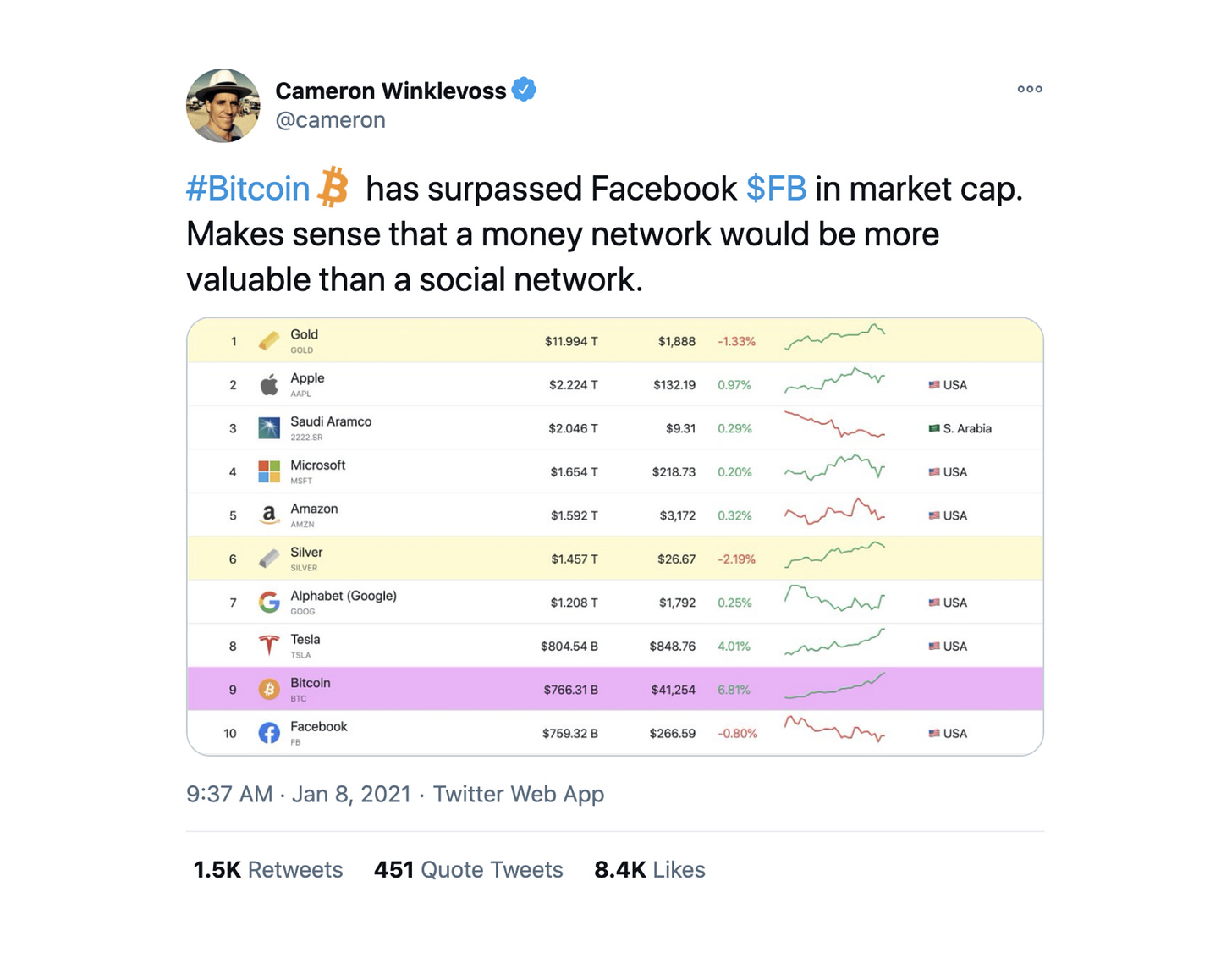

Zoom, symbol of the pandemic, will feel the pressure to find a second act most acutely, with the vaccine putting the video-conferencer on the clock. As face-to-face meetings become possible once again, Zoom may look less like the vanguard of an inevitable future, more like a standalone product vulnerable to being squeezed by Big Tech's product suites.

Microsoft Team's effective neutering of Slack is the cautionary tale here. To prevent a similar outcome, expect Zoom to secure its "conferencing pipeline." The company's biggest vulnerability is that meetings do not start with Zoom. They begin with email, then migrate to the calendar, and finally, end in video conferencing. Google's obnoxious attempts to plaster the Meet button across Gmail and GCal emphasize this, representing an attempt to hijacking Zoom’s pipeline while securing its own.

Even if Zoom cannot compete with Google or Microsoft's full suite of products, it must secure this particular conduit. While the company is said to be exploring building both solutions in house, an acquisition, at least when it comes to email, makes considerably more sense.

Superhuman, last valued at $260 million in 2019, would represent a strategic choice. Rather than a full-suite email service, Superhuman is a client, meaning users don't need to register a new email address to join, a significant source of friction. Moreover, Superhuman has focused on premium knowledge workers (if not expressly enterprise), which should match well with Zoom's customer base. The downside is that Superhuman has not achieved mass-market adoption due to its pricing. Still, as part of a bundle, Zoom could afford to offer the product for free, allowing it to win users away from Gmail and Outlook with its superior UX.

Superhuman does provide limited calendaring features, which Zoom could expand as part of an acquisition. Should Zoom wish to bolster its efforts in this space, Clockwise or Calendly might make interesting plays, both offering avenues to ensure Zoom remains the default video-conferencer.

Zoom will be far from the only player in the M&A arena. Four other Big Tech acquisitions I'd like to see happen:

🌳 💵 Argent, impact et plus-values

Circles UBI | Basic Income on the Blockchain

Our experts predict what's in store for startups in 2021 | Sifted

Total Cryptocurrency Market Value Hits Record $1 Trillion - CoinDesk

4 trends for indie hackers in 2021: virtual team building, content repurposing + 2 more